Market Outlook

April 11, 2019

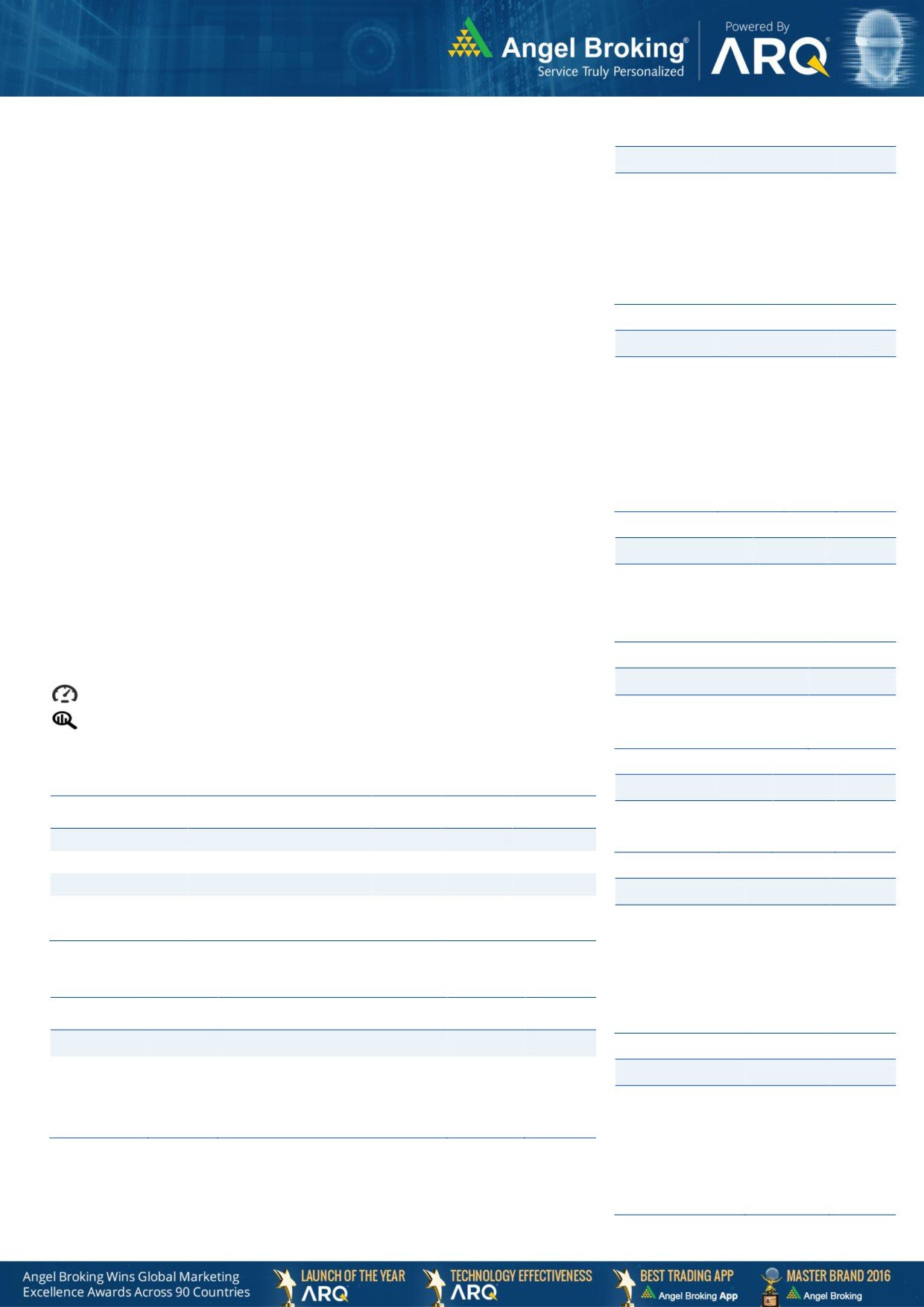

Domestic Indices

Chg (%)

(Pts)

(Close)

Market Cues

BSE Sensex

(0.9)

(354)

38,585

Indian markets are likely to open flat tracking global indices and SGX Nifty.

Nifty

(0.8)

(88)

11,584

US Stocks moved mostly higher over the course of the trading day on Wednesday.

Mid Cap

0.2

23

15,420

With the upward move, the tech-heavy Nasdaq ended the session at its best closing

Small Cap

(0.1)

(16)

14,971

level in over six months. The Dow ended up 0.01 percent to 26,157 and the Nasdaq

Bankex

1.1

366

33,868

up by 0.7 percent to 7,964.

U.K. markets rose on Tuesday and the pound edged higher for a second straight

Global Indices

Chg (%)

(Pts)

(Close)

session, as British Prime Minister Theresa May holds last-minute Brexit talks with the

Dow Jones

0.01

7

26,157

leaders of Germany and France, to urge them to back her request to delay Brexit

Nasdaq

0.7

55

7,964

again until 30 June. The FTSE 100 was up by 0.3% to 7,473.

FTSE

0.3

21

7,473

On domestic front, Indian shares fell on Wednesday on growth worries after the

Nikkei

0.4

83

21,806

International Monetary Fund (IMF) cut its growth forecast for India and the

Hang Seng

(0.2)

(50)

29,936

global economy, citing heightened trade tensions. The benchmark BSE Sensex was

Shanghai Com

0.9

30

3,247

ended down by 0.9% to 38,585 at the end of trading session.

Advances / Declines

BSE

NSE

News Analysis

1,511

1,145

Advances

JSW Steel raises $500mn via international bond issue

1,072

638

Declines

155

118

Detailed analysis on Pg2

Unchanged

Investor’s Ready Reckoner

Volumes (` Cr)

Key Domestic & Global Indicators

BSE

2,709

Stock Watch: Latest investment recommendations on 150+ stocks

NSE

30,164

Refer Pg5 onwards

Top Picks

Net Inflows (` Cr)

Net

Mtd

Ytd

CMP

Target

Upside

Company

Sector

Rating

FII

(895)

822

(199)

(`)

(`)

(%)

Blue Star

Capital Goods

Buy

685

867

26.6

*MFs

(518)

5,097

6,274

ICICI Bank

Financials

Buy

394

460

16.8

Parag Milk Foods

Others

Buy

249

330

32.7

Top Gainers

Price (`)

Chg (%)

Bata India

Others

Accumulate

1,392

1,479

6.2

109

12.2

KEI Industries

Capital Goods

Buy

400

486

21.5

510

8.1

More Top Picks on Pg4

FSL

51

5.7

Key Upcoming Events

ITI

104

5.6

Previous

Consensus

Date

Region

Event Description

ReadingExpectations

91

4.9

Mar 26, 2019

TU Central Bank Inflation Report

Mar 27, 2019

TH Exports YoY

0.06

--

Top Losers

Price (`)

Chg (%)

Mar 27, 2019

TH Exports

$22380m

--

LAKSHVILAS

93

-4.9

Mar 30, 2019

TH Imports YoY

0.24

--

RCOM

3

-4.8

Mar 30, 2019

TH Imports

$21776m

--

More Events on Pg7

209

-3.6

247

-3.5

1,443

-3.5

As on Apr 09, 2019

Market Outlook

April 11, 2019

News Analysis

JSW Steel raises $500mn via international bond issue

The country's largest private sector steel-maker JSW Steel Wednesday raised $500

high demand from investors across Europe and Asia, and had attracted bids worth

$1.75 billion, merchant banking sources said. The company, which is rated one

notch below the investment grade, managed a coupon of 5.95 per cent, they said.

The issue had received Ba2 rating with a positive outlook by global ratings agency

Moody's.

The fund raising was in line with a May 2017 board resolution to raise up to $1

billion in one or more tranches of international bond sales, the company informed

the exchanges. The company, which has an installed capacity of 18 million tonne,

is intending to use the proceeds to retire debt and also for capital expenditure,

according to Moody's.

Economic and Political News

India's weak electricity demand signals more slowdown pain ahead

IMF flags concern over India's high stock of bad bank loans

UP cane arrears of Rs 10,000 crore to ease by 40% as polling nears

IMF scales down India's growth projection for current fiscal to 7.3%

India delays May order for Iran oil, awaits clarity on US sanctions: Report

Corporate News

PE funds, hospital groups eye regional chains with a sizable footprint

Federation of Automobile Dealers Associations see green shoots of recovery

Jet saga: Lenders delay stake sale to make room for more potential bidders

Wipro board to consider equity share buyback proposal on April 16

Indiabulls merger with bank will lead to CAGR of 25%: MD Lakshmi Vilas

Bank

Market Outlook

April 11, 2019

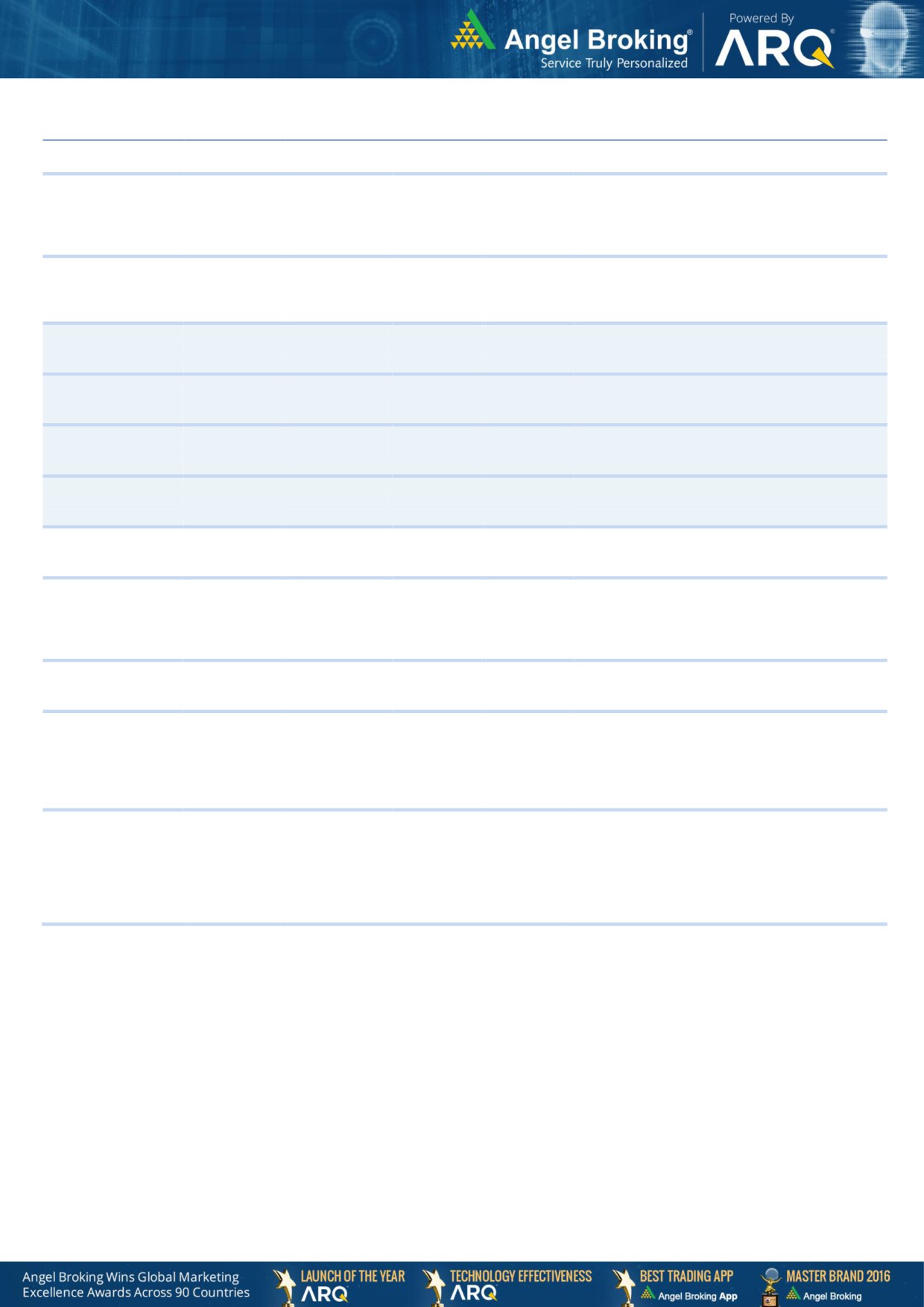

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

6,598

685

867

26.6

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

ICICI Bank

2,53,795

394

460

16.8

resolution of NPA would reduce provision cost,

which would help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

3,157

400

486

21.5

B2C sales and higher exports to boost the revenues

and profitability

Expected to benefit from the lower capex

Music Broadcast Limited

1,654

59

95

62.3

requirement and 15 year long radio broadcast

licensing.

Strong brands and distribution network would

Siyaram Silk Mills

2,012

429

606

41.1

boost growth going ahead. Stock currently trades

at an inexpensive valuation.

GST regime and the Gujarat plant are expected to

Maruti Suzuki

2,17,017

7,184

10,820

50.6

improve the company’s sales volume and margins,

respectively.

We expect loan book to grow at 24.3% over next

GIC Housing

1,431

266

424

59.5

two year; change in borrowing mix will help in NIM

improvement

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,648

738

1,000

35.5

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

We expect financialisation of savings and

Aditya Birla Capital

21,266

97

151

56.3

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

2,091

249

330

32.7

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

HDFC Bank

6,10,756

2,243

2,500

11.5

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

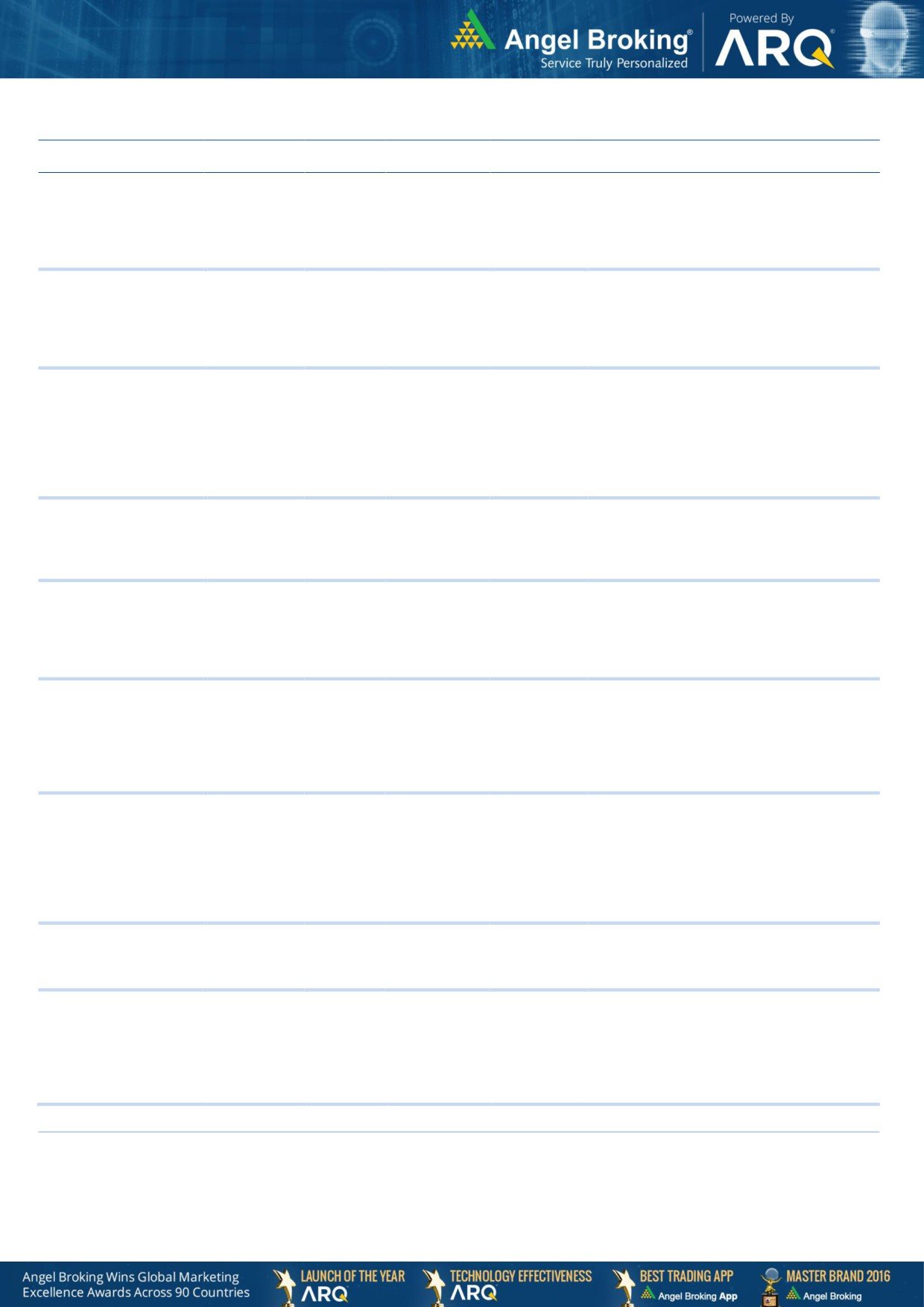

Market Outlook

April 11, 2019

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect strong PAT growth on back of

healthy growth in automobile segment (on back

of new launches and facelifts in some of the

M&M

83,070

668

1,050

57.1

model ) and strong growth in Tractors segment

coupled by its strong brand recall and

improvement in rural sentiment

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in India with a

market share of

55.4%. It is a one-stop

Amber Enterprises

2,622

834

984

18.0

solutions provider for the major brands in the

RAC industry and currently serves eight out of

the 10 top RAC brands in India

BIL is the largest footwear retailer in India,

offering footwear, accessories and bags across

brands. We expect BIL to report net PAT CAGR

of

~16% to

~`3115cr over FY2018-20E

Bata India

17,892

1,392

1,479

6.2

mainly due to new product launches, higher

number of stores addition and focus on

women’s high growth segment and margin

improvement

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by rising

Shriram Transport Finance

27,147

1,197

1,764

47.4

bond yields on the back of stronger pricing

power and an enhancing ROE by 750bps over

FY18-20E, supported by decline in credit cost.

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom

Jindal Steel & Power Limited

17,704

183

327

78.8

line front, we expect JSPL to turn in to profit by

FY19 on back of strong operating margin

improvement.

GMM Pfaudler Limited (GMM) is the Indian

market leader in glass-lined (GL) steel

equipment. GMM is expected to cross CAGR

GMM Pfaudler Ltd

1,740

1,190

1,400

17.6

15%+ in revenue over the next few years

mainly led by uptick in demand from user

industries and it is also expecting to increase its

share of non-GL business to 50% by 2020.

Aurobindo Pharmaceuticals, amongst the

Indian Pharmaceutical companies, is well

placed to face the challenging generic markets,

given its focus on achieving growth through

Aurobindo Pharmaceuticals

46,270

790

890

12.7

productivity. Aurobindo will report net revenue

& net profit CAGR of ~13% & ~8% resp.

during FY2018-20E. Valuations are cheap V/s

its peers and own fair multiples of 17-18x.

We believe advance to grow at a healthy CAGR

of 35% over FY18-20E. Below peers level ROA

RBL Bank

28,743

674

763

13.3

(1.2% FY18) to expand led by margin

expansion and lower credit cost.

TTK Prestige has emerged as one of the leading

brands in kitchen appliances in India after its

successful transformation from a single product

TTK Prestige

9,760

8,449

9,250

9.5

company to offering an entire gamut of home

and kitchen appliances. We are expecting a

CAGR of 18% in revenue and 25% in PAT over

FY2018-20.

Maintain Hold.

Source: Company, Angel Research

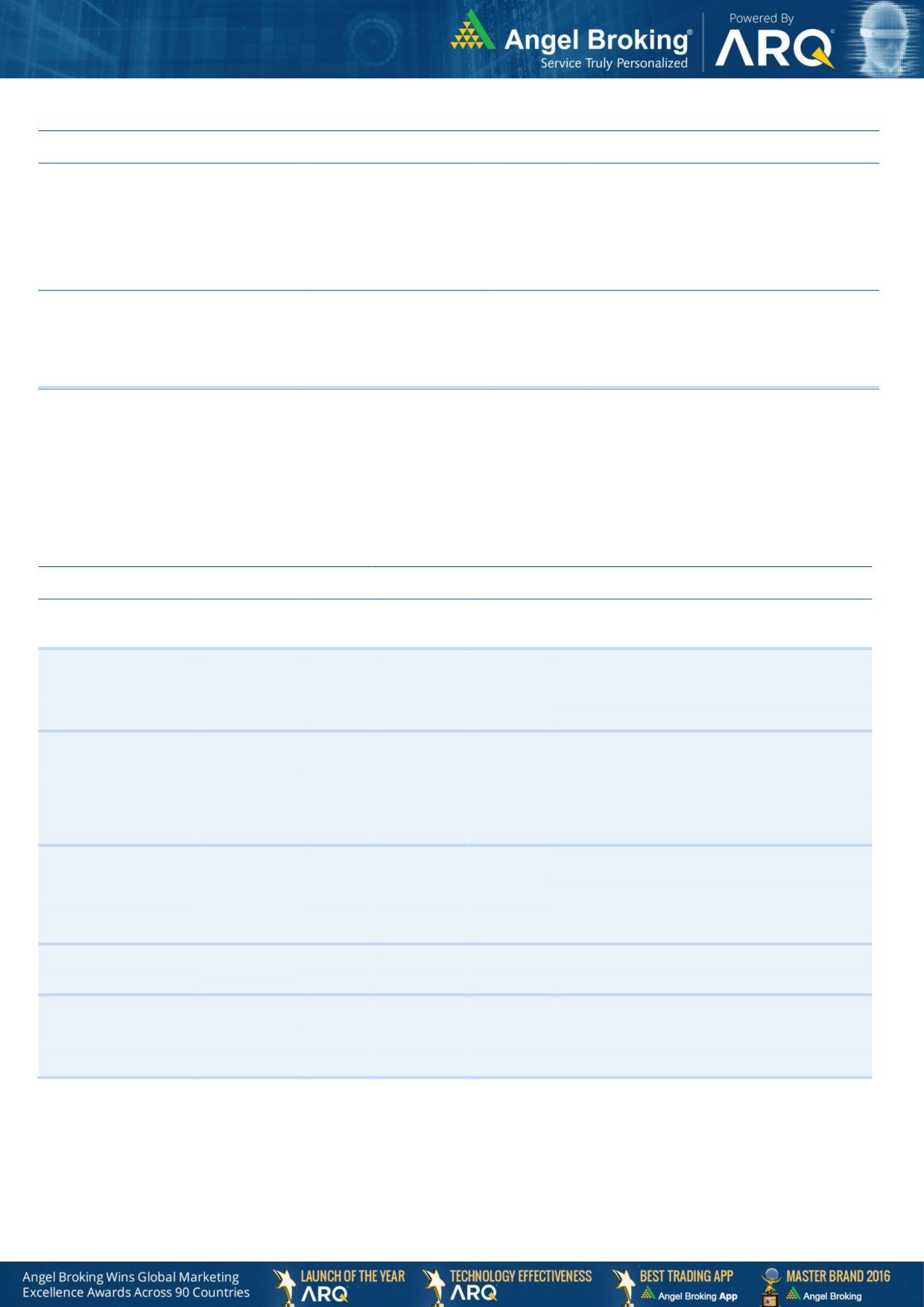

Market Outlook

April 11, 2019

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect Inox Wind to report exponential

growth in top-line and bottom-line over FY19-

20E. The growth would be led by changing

renewable energy industry dynamics in favor of

Inox Winds

1,515

68

120

75.8

wind energy segment viz. changes in auction

regime from Feed-In-Tariff (FIT) to reverse

auction regime and Government’s guidance for

10GW auction in FY19 and FY20 each.

Considering the strong CV demand due to

change in BS-VI emission norms (will trigger

pre-buying activities), pick up in construction

Ashok Leyland

26,816

91

156

70.8

activities and no significant impact on industry

due to recent axle load norms, we recommend

BUY on Ashok Leyland at current valuations.

Source: Company, Angel Research

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth

CCL Products

3,691

277

360

29.8

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

2,073

1,389

2,178

56.8

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,824

2,300

2,500

8.7

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years. We can book out from the stock with 16%

profit at Rs. 2500 TP.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

2,065

168

256

52.0

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

L&T Fin’s new management is on track to achieve

L&T Finance Holding

29,073

145

210

44.4

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Well planned strategy to grow small business loans

and cross-selling would propel fees income. We

Yes Bank

62,112

268

290

8.1

expect YES to grow its advance much higher than

industry and improvement in asset quality to

support profitability.